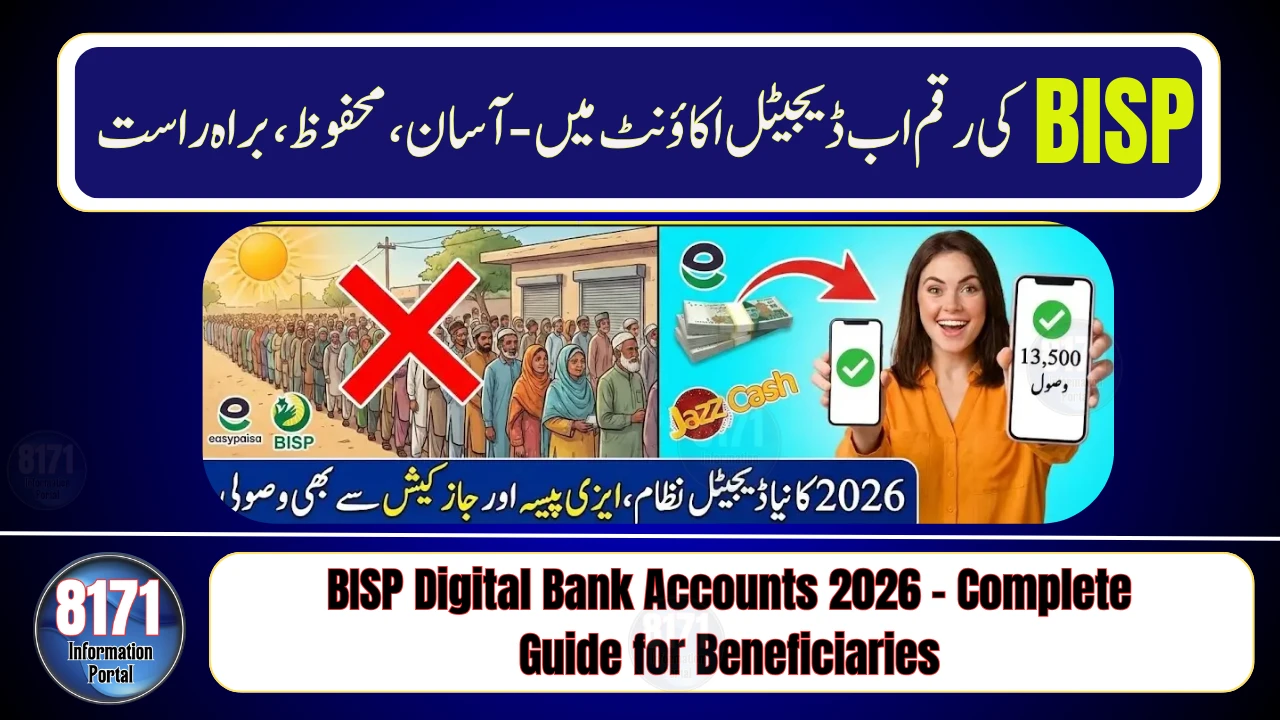

The BISP Digital Bank Accounts 2025 initiative is designed to shift beneficiaries from cash-based payments to secure digital banking, ensuring transparency, safety, and direct access to funds. Under this system, eligible BISP beneficiaries will receive their payments directly into digital bank or wallet-based accounts, reducing dependency on payment camps and agents.

This change helps women beneficiaries manage funds independently, withdraw payments anytime, and track transaction history without hassle. The program is being rolled out in phases, starting with selected districts, and will gradually cover all eligible families across Pakistan.

If you’re receiving BISP or Ehsaas assistance, understanding how these digital bank accounts work, who qualifies, and what steps to take is essential. This guide explains everything clearly—without confusion or false claims.

What Are BISP Digital Bank Accounts?

Key Purpose

-

Direct transfer of BISP payments

-

Reduced fraud and delays

-

Financial inclusion for women

Who Is Eligible for Digital Accounts in 2025

-

Active BISP beneficiary

-

Valid CNIC

-

Biometric verification completed

-

Updated NSER / Dynamic Survey

How BISP Digital Accounts Will Work

| Step | Process |

|---|---|

| 1 | Beneficiary shortlisted by BISP |

| 2 | Account created with partner bank/wallet |

| 3 | Biometric verification |

| 4 | Payment transferred digitally |

| 5 | Cash withdrawal via ATM/agent |

Benefits of Digital Bank Accounts

-

24/7 access to funds

-

No middlemen

-

SMS alerts & transaction record

-

Safer payments for women

Conclusion

BISP Digital Bank Accounts 2025 mark a major step toward secure and transparent payments. Keep your CNIC and survey data updated, and follow only official BISP announcements for account activation details.

FAQs

Q1: Are BISP digital bank accounts active in 2025?

Yes, rollout has started in selected areas.

Q2: Do all beneficiaries get accounts automatically?

No, accounts are issued in phases.

Q3: Can I choose my bank?

No, BISP assigns partner banks or wallets.

Q4: Will cash payments stop immediately?

No, both systems may run during transition.

Q5: Is there any fee for digital accounts?

No, account setup is free.

Q6: Can I withdraw money anytime?

Yes, once funds are credited.